By signing up you’ll also receive our ongoing free lessons and special offers. Don’t worry, we value your privacy and you can unsubscribe at any time.

Nail your rudiments and improve your drumming.

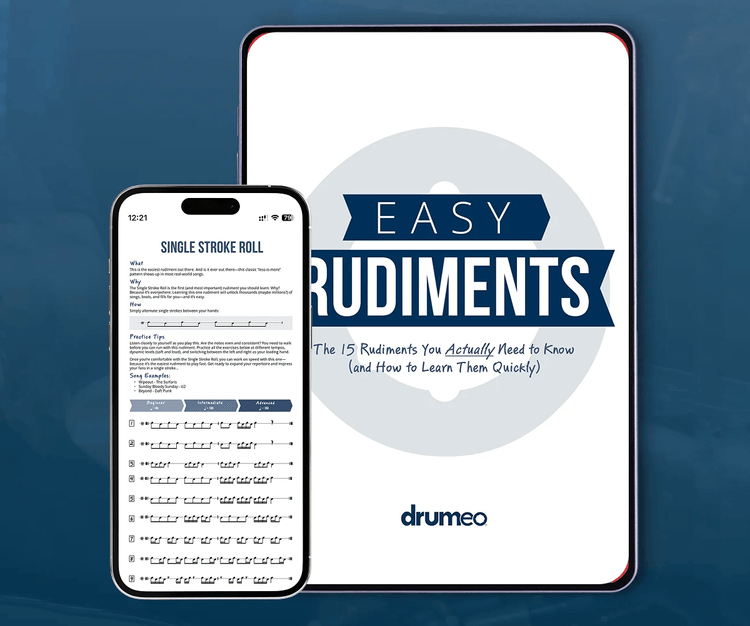

Easy Rudiments is your simplified guide to learning the 15 rudiments you’ll actually use on a drum set.

No credit card. No spam.

Just enter your email to get your free e-book:

Don’t worry, we value your privacy and you can unsubscribe at any time.